Breaking Down the TCFD Framework: What It Means for Philippine Companies in 2025

Meta description: Learn how Philippine companies can align with the TCFD framework in 2025. Discover its four pillars, benefits, and how GCSS, Inc. helps deliver investor-grade ESG reporting.

Updated October 2025

The Task Force on Climate-related Financial Disclosures (TCFD) has become the gold standard for climate reporting. What began as a voluntary framework is now embedded into regulations and investor expectations around the world. With the IFRS Foundation fully integrating TCFD into its climate disclosure standard (IFRS S2), companies in the Philippines must act now to align their sustainability reporting with this global benchmark.

For business leaders navigating climate action, net zero transitions, and ESG reporting, understanding TCFD is no longer optional—it’s a matter of credibility, competitiveness, and long-term growth.

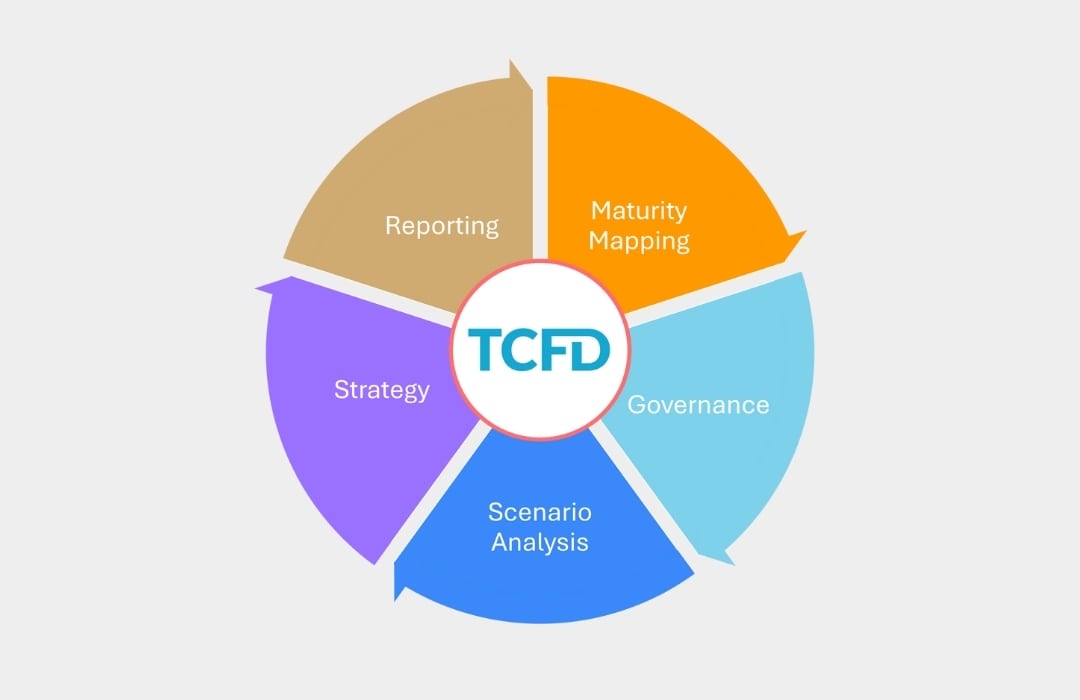

The Four Pillars of TCFD

The TCFD framework is built on four interconnected pillars. Each represents what investors and regulators expect companies to disclose:

1. Governance

How does your board and management oversee climate-related risks and opportunities?

- Clear board accountability for ESG

- Defined management responsibilities for climate action

- Integration of sustainability into corporate governance practices

2. Strategy

What is the actual and potential impact of climate risks and opportunities on your business, strategy, and financial planning?

- Assessing physical risks (e.g., typhoons, flooding) and transition risks (e.g., policy shifts, carbon pricing)

- Aligning strategy with net zero commitments and sustainable development goals (SDGs)

- Testing resilience with climate scenario analysis

3. Risk Management

How are climate-related risks identified, assessed, and managed?

- Embedding ESG risks into enterprise risk management systems

- Linking climate risk management with broader corporate compliance

- Establishing escalation pathways up to the audit and risk committees

4. Metrics and Targets

What climate-related metrics and targets does your company use?

- Scope 1, 2, and 3 greenhouse gas (GHG) emissions

- Targets for carbon reduction and net zero pathways

- Metrics on energy use, water efficiency, and other ESG indicators

Investors don’t just want numbers—they want investor-grade data that is accurate, comparable, and auditable.

Why TCFD Matters for Philippine Companies

The Philippines is one of the most climate-vulnerable countries in the world. For local businesses, this reality means TCFD is not just a reporting exercise but a strategic necessity:

- Access to green financing: Investors and lenders require TCFD-aligned disclosures

- Investor confidence: Transparent reporting builds trust with global capital markets

- Regulatory readiness: With the SEC requiring sustainability reporting, alignment with global frameworks like TCFD and IFRS ensures compliance and competitiveness

- Resilience: Businesses that disclose and act on climate risks are better positioned to adapt to disruptions and seize growth opportunities

Stay ahead of ESG regulations.

Learn more about our Sustainability Reporting services

The Consultant’s Advantage

Adopting TCFD is complex. Consultants like GCSS, Inc. play a critical role by:

- Translating global frameworks into Philippine business contexts

- Supporting materiality assessments to identify relevant climate risks

- Building robust ESG data systems for reporting

- Training boards and executives on governance roles in climate action

- Ensuring disclosures align with IFRS S2 and investor expectations

From Reporting to Resilience

For Philippine companies, the TCFD framework is both a challenge and an opportunity. By adopting it, businesses can unlock green financing, investor trust, and competitive advantage in an increasingly sustainability-driven world.

The time to act is now. Companies that treat TCFD as more than compliance—those that embed it into strategy and governance—will lead the way to a resilient and sustainable Philippines.

Reach out at sales@gcssinc.com to begin your IFRS- and TCFD-aligned ESG journey. Book your discovery call here and talk to our experts today.

Follow GCSS, Inc. on LinkedIn and Facebook for the latest ESG trends, reporting best practices, and sustainability insights.

Subscribe to our newsletter for expert insights, practical frameworks, and trend analyses delivered weekly. For business leaders and executives, join the discussion and conversation here.

With GCSS, Inc. as your sustainability consultant, you don’t just disclose climate risks—you turn them into opportunities for long-term resilience and growth.

Quick Links

Our Programs

© 2025 GCSS - Gaia Corporate Sustainability Solutions Inc..